Global Minimum Variance for a Portfolio of Any Size Using Differential Calculus, Linear Algebra, and C# (Part 1)

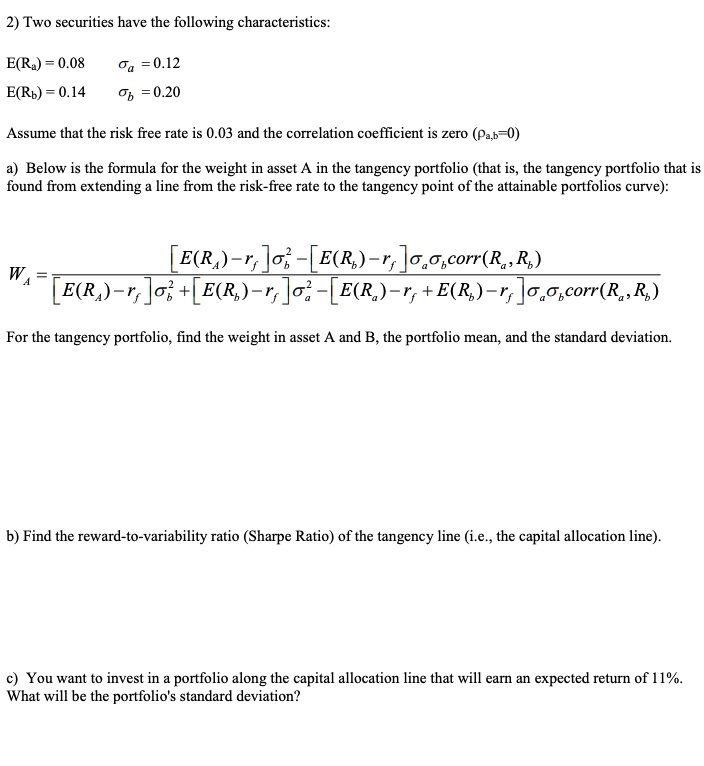

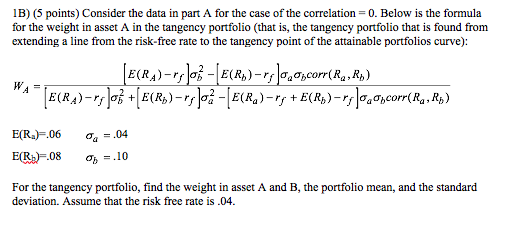

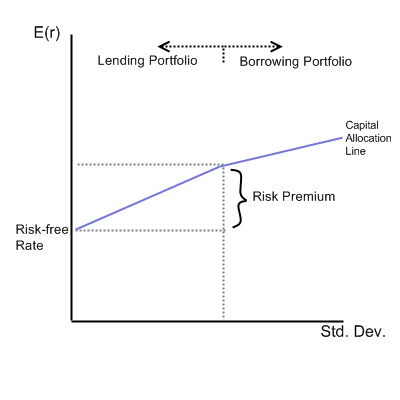

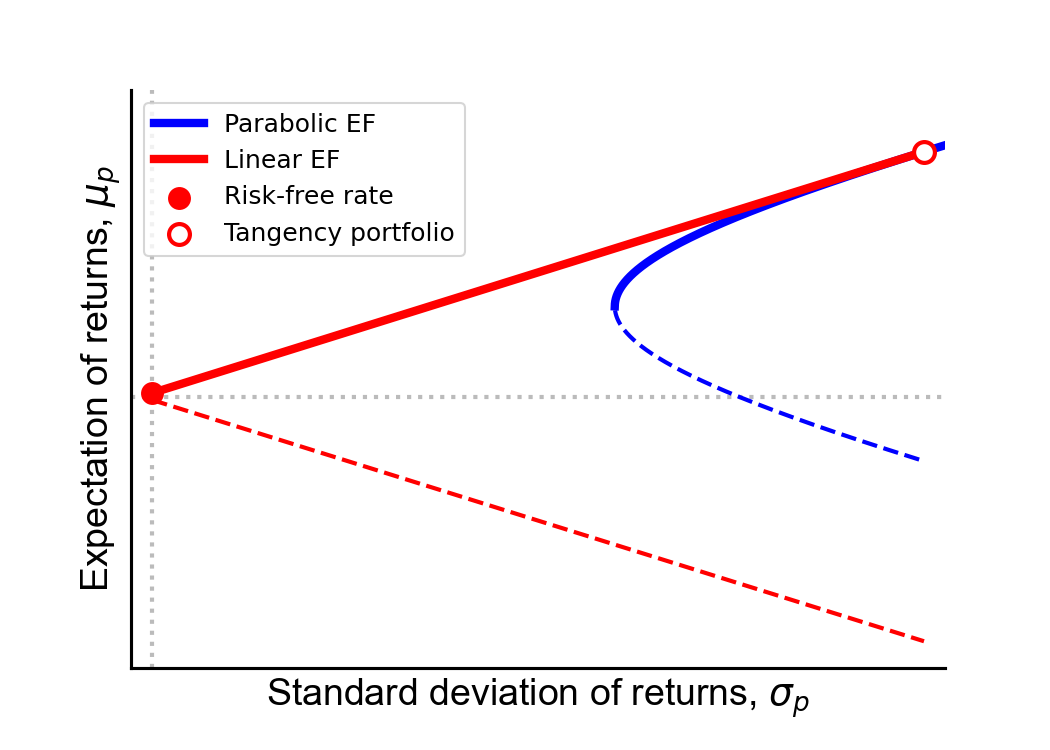

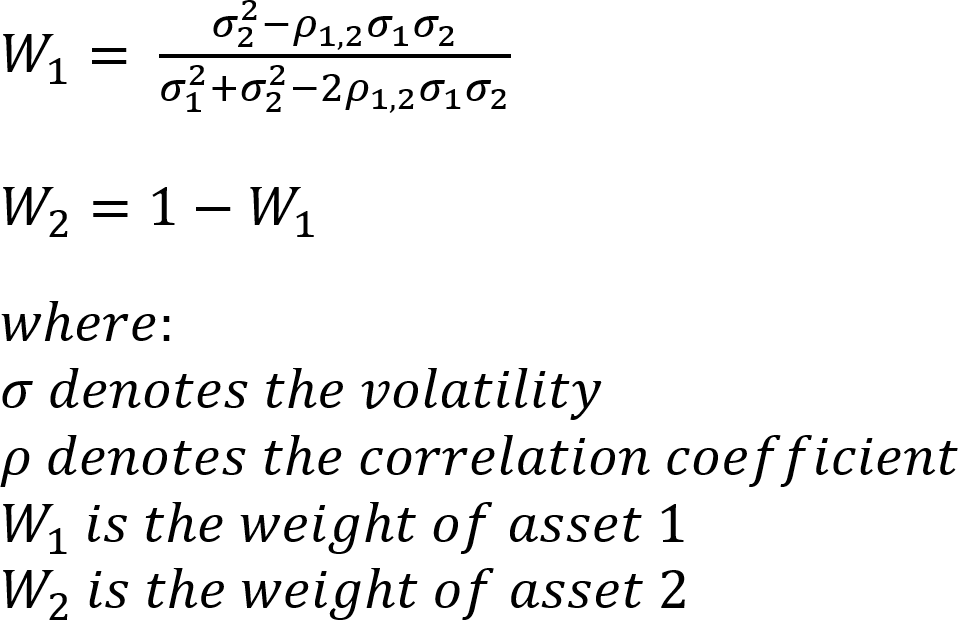

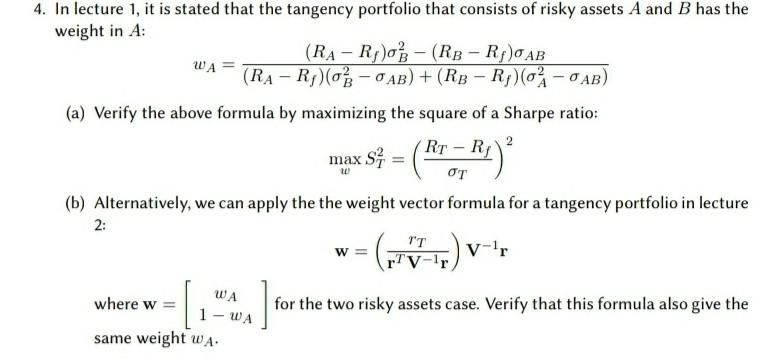

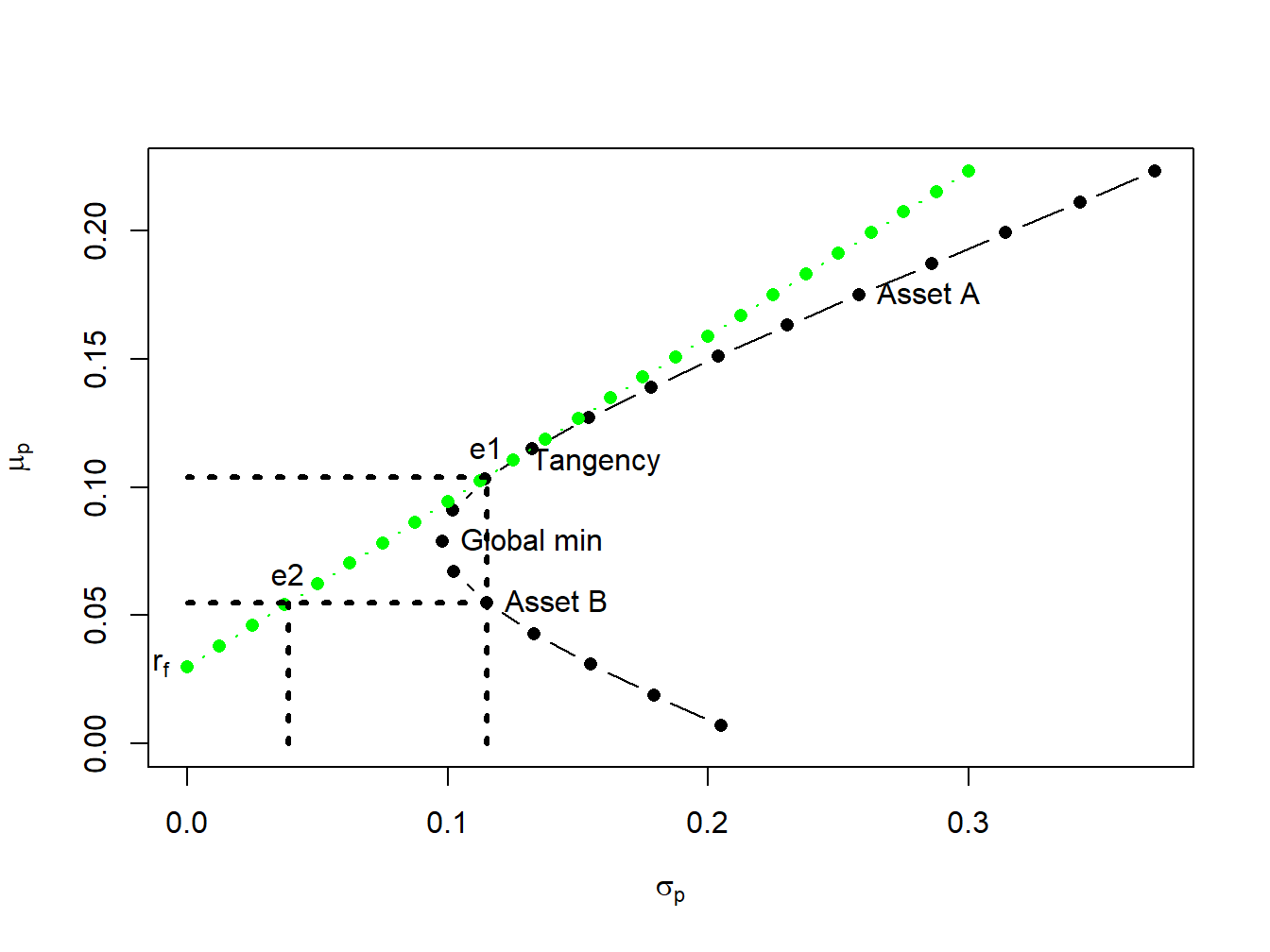

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R