12.5 Computing Efficient Portfolios of N risky Assets and a Risk-Free Asset Using Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

Global Minimum Variance for a Portfolio of Any Size Using Differential Calculus, Linear Algebra, and C# (Part 1)

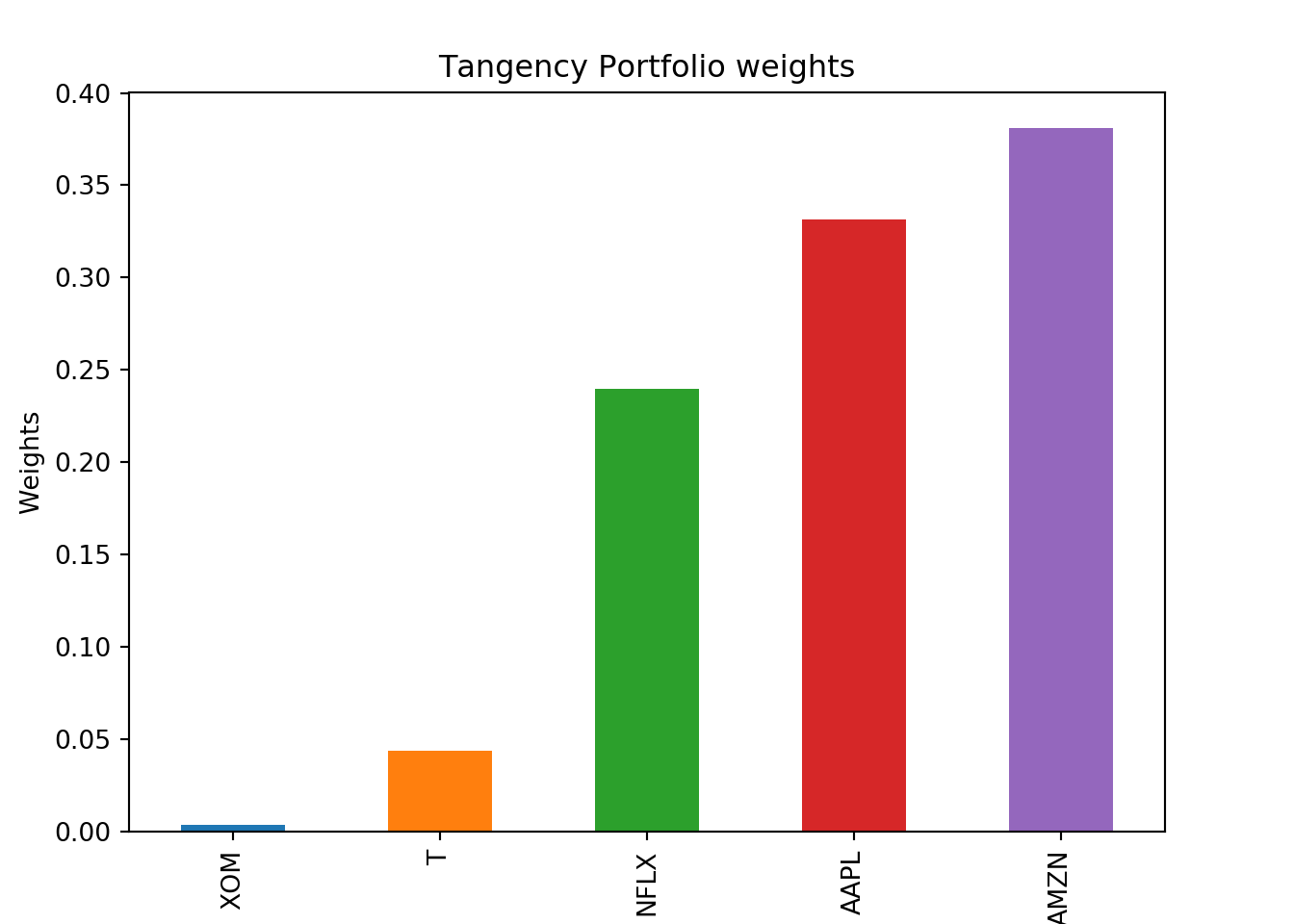

python - Compute tangency portfolio with asset allocation constraints - Quantitative Finance Stack Exchange

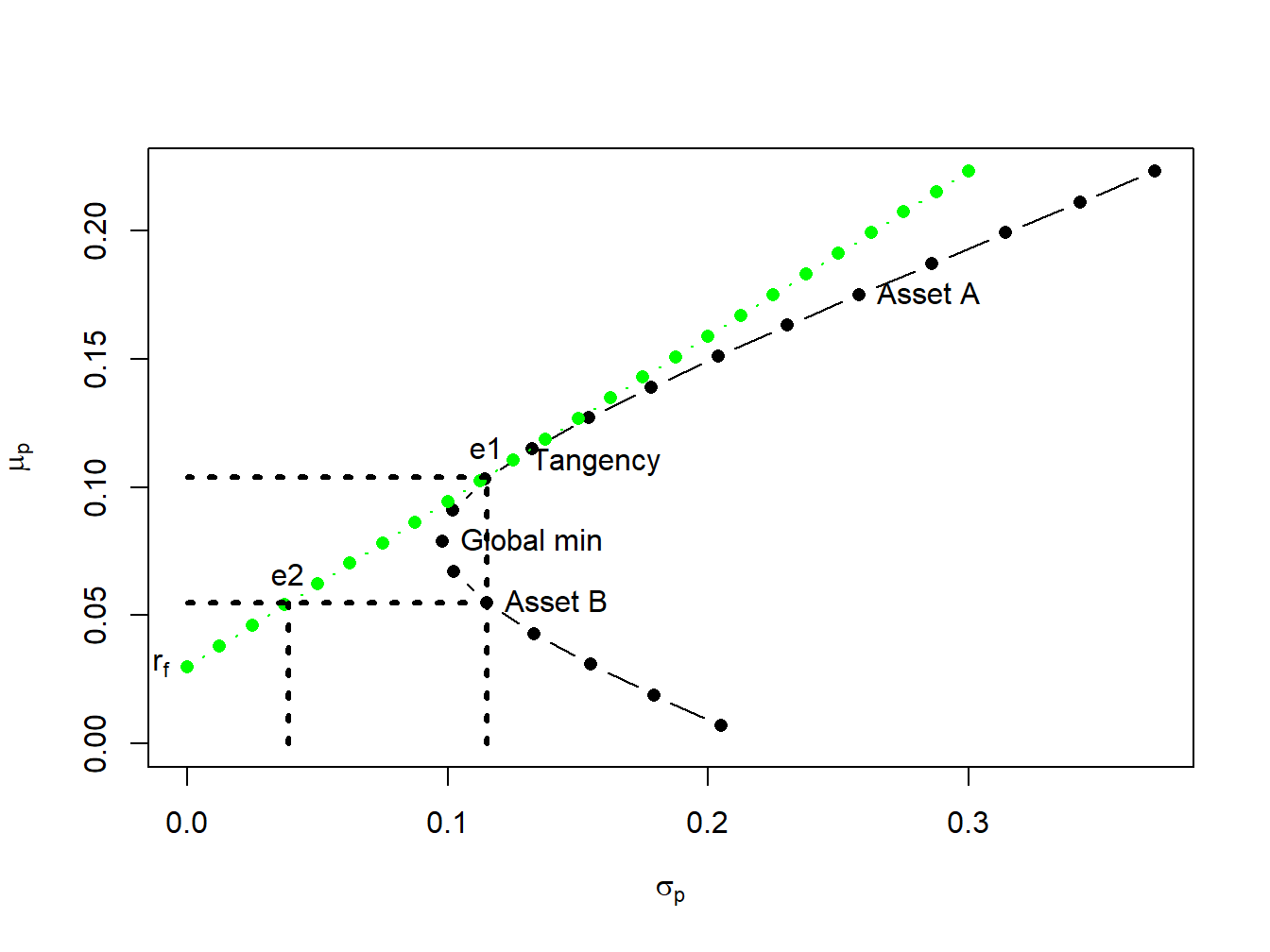

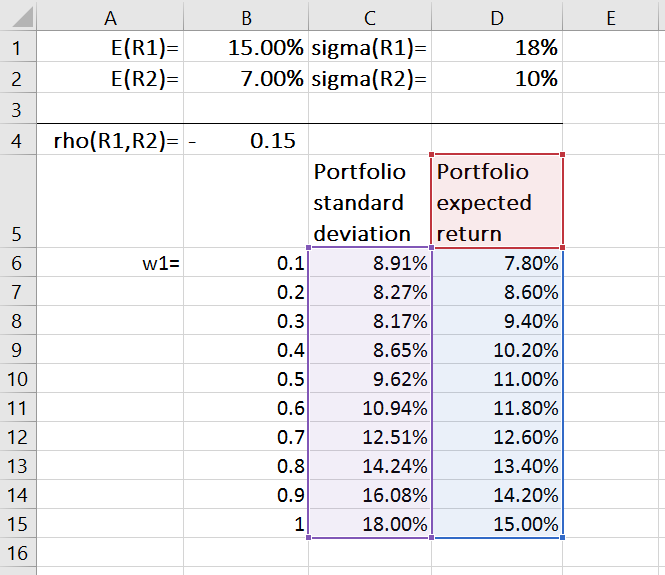

Portfolio optimization using the efficient frontier and capital market line in Excel — Angel Demirev

python - Compute tangency portfolio with asset allocation constraints - Quantitative Finance Stack Exchange