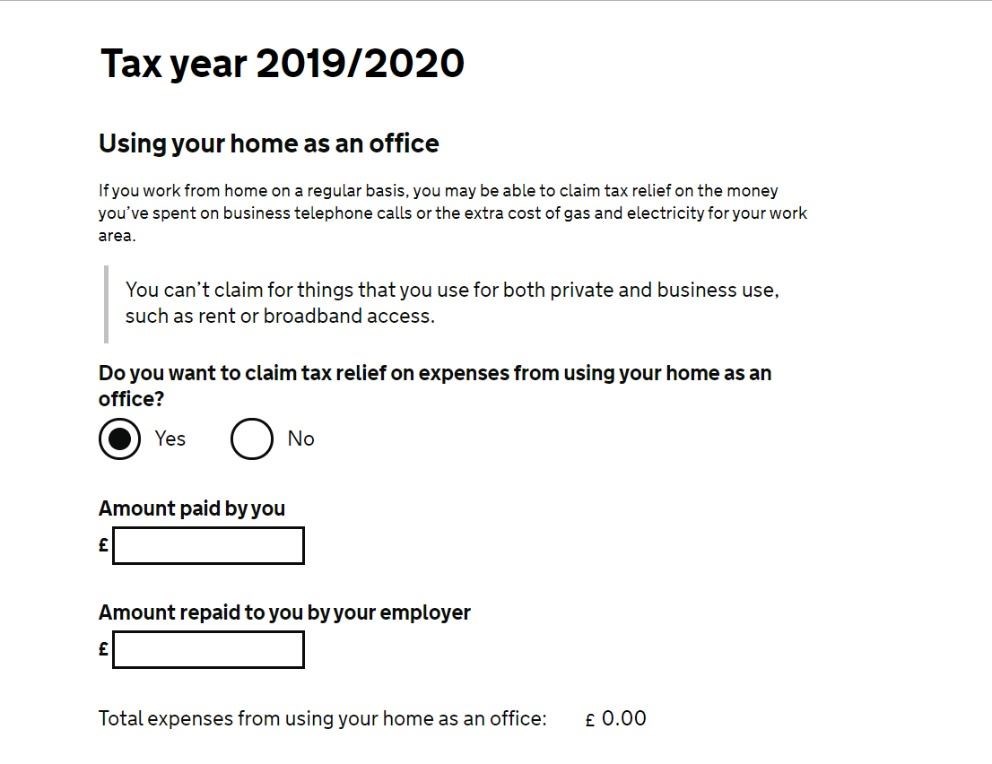

You can claim $2 for each day you worked from home during that period plus any additional days you worked at home in 2020 due to the COVID-19 pandemic." Read more... https://www.canada.ca/en/revenue-agency/services/tax /individuals/topics/about-your-tax ...

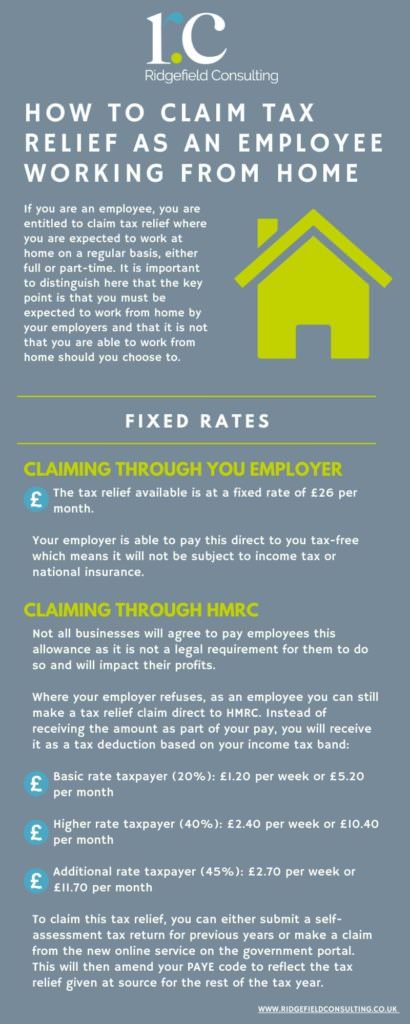

Martin Lewis: Worked from home due to coronavirus before 6 April 2022? You can still claim tax relief worth up to £280

![Allowable Limited Company Expenses - A Complete Guide [2023] Allowable Limited Company Expenses - A Complete Guide [2023]](https://res.cloudinary.com/goforma/image/upload/v1647614684/tax/limited-company-director-expenses-tax-allowance.png)

![The Best Home Office Deduction Worksheet for Excel [Free Template] The Best Home Office Deduction Worksheet for Excel [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6349b18d4a6db382f5149518_home-office-expense-worksheet.png)