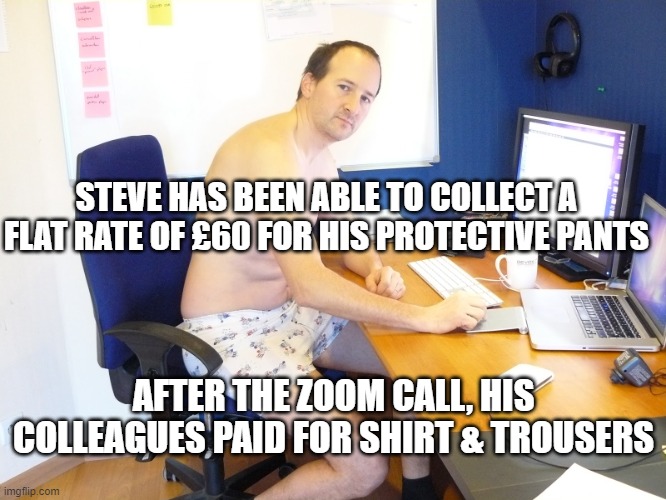

Martin Lewis: Worked from home due to coronavirus before 6 April 2022? You can still claim tax relief worth up to £280

Working from home income tax deductions: What does it mean for me? | Personal Finance | Finance | Express.co.uk

What home office expenses can I claim as a limited company director? - West Lancs Chartered Accountants